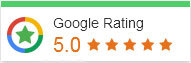

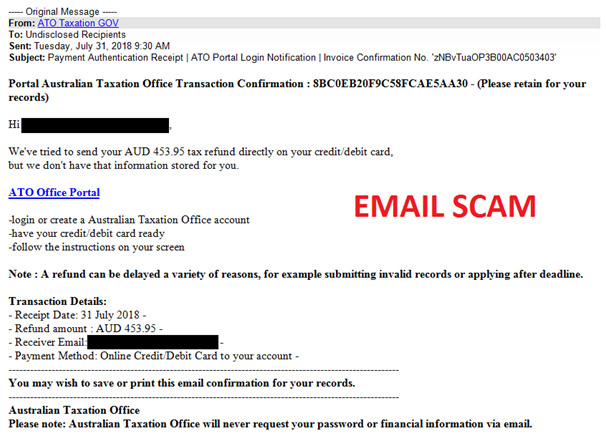

July 2018 email scam – ATO impersonation

Scammers are sending fake ATO emails claiming they don’t have credit/debit card details stored. The email instructs the recipients to login to a fake site called ‘ATO Office Portal’ or ‘ATO Gateway Portal’. The site asks for information including online banking credentials, credit card numbers and limits and personal address information.

Do not click on the link and do not disclose the information requested.

This scam email:

- Is not sent from a legitimate @ato.gov.au sender is unexpected asks you to click a link that appears to be the ATO website but when hovering over the link it does not lead to an ato.gov.au address.

We won’t send you an email with a hyperlink directing you to log on to an online service to provide personal identifying information. All online management of your tax affairs should be carried out via your myGov account. The ATO does not have an online ‘Tax Refund’ form.

List of the tax deductions for uber drivers and rideshare drivers

You can claim a deduction from your taxable income for all expenses which you incur as part of earning your income as an Uber driver-partner. This is the case whether you have an ABN. You can only claim costs which relate to your business. If any expenses are partly private, they can only be claimed proportionately. If they are wholly private, they can’t be claimed at all. Amongst the typical deductions you may be able to claim are the following:

Motor Vehicle Expenses

There are two different methods available for claiming motor vehicle expenses, the Logbook Method and the Cents Per Kilometre method. You can choose whichever one gives you the biggest tax deduction. Let’s take a look at these two methods in detail.

Logbook Method

If you have kept a valid logbook, you can claim a percentage of your vehicle running expenses, including:

- Fuel

- Registration

- Insurance

- Servicing, repairs, tyres and other maintenance costs

- Cleaning costs

- Depreciation on the purchase price of your car (if you own your car)

- Interest (if you have a loan on your car)

- Rental/hire/lease fees (if you lease/rent your car)

If you wish to claim these expenses you MUST have a valid logbook. We’ll explain the requirements for a logbook in more detail below.

The records you’ll need to keep for your car expenses are:

- Fuel – fuel receipts are the best form of evidence, so we suggest keeping an envelope in your glovebox to collect these. If you don’t have receipts, the ATO will accept your bank statements as evidence.

- Other Running Costs – you’ll need receipts or bank records of your registration, insurance, servicing, repairs, tyres, maintenance, cleaning and other costs

- Car Washes – if you don’t get a receipt for your car washes, the ATO will accept a diary note or other handwritten note with the date and amount of your car wash. Keep a little notebook handy in your glovebox to write these down.

- Depreciation – you’ll need the tax invoice or purchase details of your car, so that depreciation can be calculated

- Interest – if you have a loan or finance, you’ll need to find out how much interest you paid (not loan repayments, just the interest) for the financial year. If you don’t have this, you will need to supply us with your original loan documents showing the amount borrowed, repayments, term of the loan and interest rate.

- Lease Payments – if you lease your car, the whole amount of your lease payments are deductible

- Logbook – to claim all of the above expenses, you must have a valid logbook. Otherwise your car expenses are irrelevant and you’ll be limited to the cents per kilometre method.

Please note that the ATO will accept bank records for your end of year tax return, but for your BAS’s you must have a tax invoice for all expenses over $82.50 in order to claim the GST back.

Cents Per Km Method

If you haven’t kept a valid logbook you’ll be restricted to using the Cents per Kilometre Method instead. You can claim 66 cents per kilometre up to a maximum of 5,000 km. This gives a maximum tax deduction of $3,300. You don’t have to have specific records of your kilometres. Instead you can make a ‘reasonable estimate’ based on your patterns of work, diary notes, records from Uber/the company you drive for, etc. Note that you can claim the kilometres in between trips as well as kilometres while you have a passenger or are making a delivery. You can also claim kilometres between home and your first trip, and from your last trip back home again.

If you’ve been driving more than just a small amount then $3,300 may be much less than your actual car expenses. This would give you a lower tax deduction and therefore a bigger tax bill. We recommend unless you are just an occasional driver you should keep a logbook so that you don’t miss out on claiming all of your expenses.

Keeping a Logbook

Here are the essentials of keeping a logbook:

- It must go for 12 weeks. It’s okay if the 12 weeks go past the 30th of June (e.g. you keep your logbook from May-July). But you must start before the 30th of June for it to count for the current year.

- You only need to make one logbook entry for each shift/session of driving, you don’t need to record individual deliveries. You also don’t need to record private/non-business trips.

- You must record the date, and the odometer reading of your car at the start and end of each shift/session of driving.

- You should start your logbook when you leave home or switch on your delivery app, and stop when you arrive back home or switch off the app. Your kms to and from home, and your kms in between deliveries can all be included.

We recommend the Zions Pocket Logbook, which you can buy from Officeworks for under $7. Using an app is also fine, as long as you are still recording your odometer readings.

It’s important to note that the kilometre records that Uber sends you are not enough to meet the ATO’s requirements of a logbook, because they don’t show your car’s odometer readings. They also don’t include your kms in between trips, so you’ll be missing out on tax deductions!

Other Expenses

Other costs that will be deductible include:

- Fees or Commissions paid to your rideshare/delivery company

- Other Fees – medical tests, police check, driver accreditation, driver training etc

- Rider Amenities – water, mints, newspapers, tisuesetc

- Tolls – you can claim tolls while on trips and tolls in between trips as well

- Parking – if you don’t get a receipt, and the amount is under $10, you may write a diary note instead, just as for car washes above.

- Cleaning Costs – for specific passenger incidents you can claim the whole amount, but general cleaning costs, such as car washes, must have your logbook percentage applied.

- Safety Equipment – hi-visibility clothing, sunglasses (though if you use them when not driving as well you must specify a percentage of Uber use).

Equipment and Accessories – dashcam, seat covers, mobile phone holder

- Mobile Phone Bills – you can claim a percentage of your mobile phone bill

- Home Office Expenses – stationery, computer expenses, a percentage of your home internet bill

- Music Apps

- Bank Fees – but only if you have a separate bank account just for Uber

- Accountant’s Fees

Costs that are not deductible include:

- Clothing – clothing is personal expense. Only safety wear, such as hi-visibility clothing or steel cap boots is deductible.

- Personal Hygiene costs – deodorant, haircuts etc

- Meals – you cannot claim for food or coffee for yourself

- Fines – even if directly related to Uber

- Driver’s Licence – your normal drivers licence is considered a private expense

If you have expenses that you’re not sure are deductible, keep the receipts anyway, and let your accountant advise you at year end whether they can be claimed.

Need to Lodge Your Tax Return?

If you’d like help preparing and lodging your Uber tax return, you’re in the right place. As specialists in tax for Rideshare and Delivery Drivers, we know what you’re entitled to claim to maximise your deductions.

But that’s not all we do. As a CPA firm and Registered Tax Agents, we offer the full spectrum of tax and accounting services. If you have a rental property, capital gains or any other tax complexities, DriveTax have the expertise and experience to help with those too.

You can read more about our services, view pricing, and browse our appointment booking calendar for a timeslot that suits you by visiting our website.

In the meantime, follow us on Facebook to stay up to date with tax news, tips and due date reminders for rideshare drivers.

Happy and safe driving!